Macfarlane are a packaging company based in Glasgow. A rather boring business, but we like boring, reliable businesses because they avoid investor exuberance and can be bought at reasonable prices. The company is a serial acquirer and has started an expansion into Europe. Let’s take a look.

Business Overview

Incorporated in 1899, not unusual for UK businesses, Macfarlane designs, manufactures and distributes protective packaging for over 20,000 customers. The business is divided into Packaging Distribution and Manufacturing Operations and utilises a ‘stock and serve’ supply model. Customers’ bespoke packaging is stored in bulk and the customer orders smaller quantities to suit their production schedule.

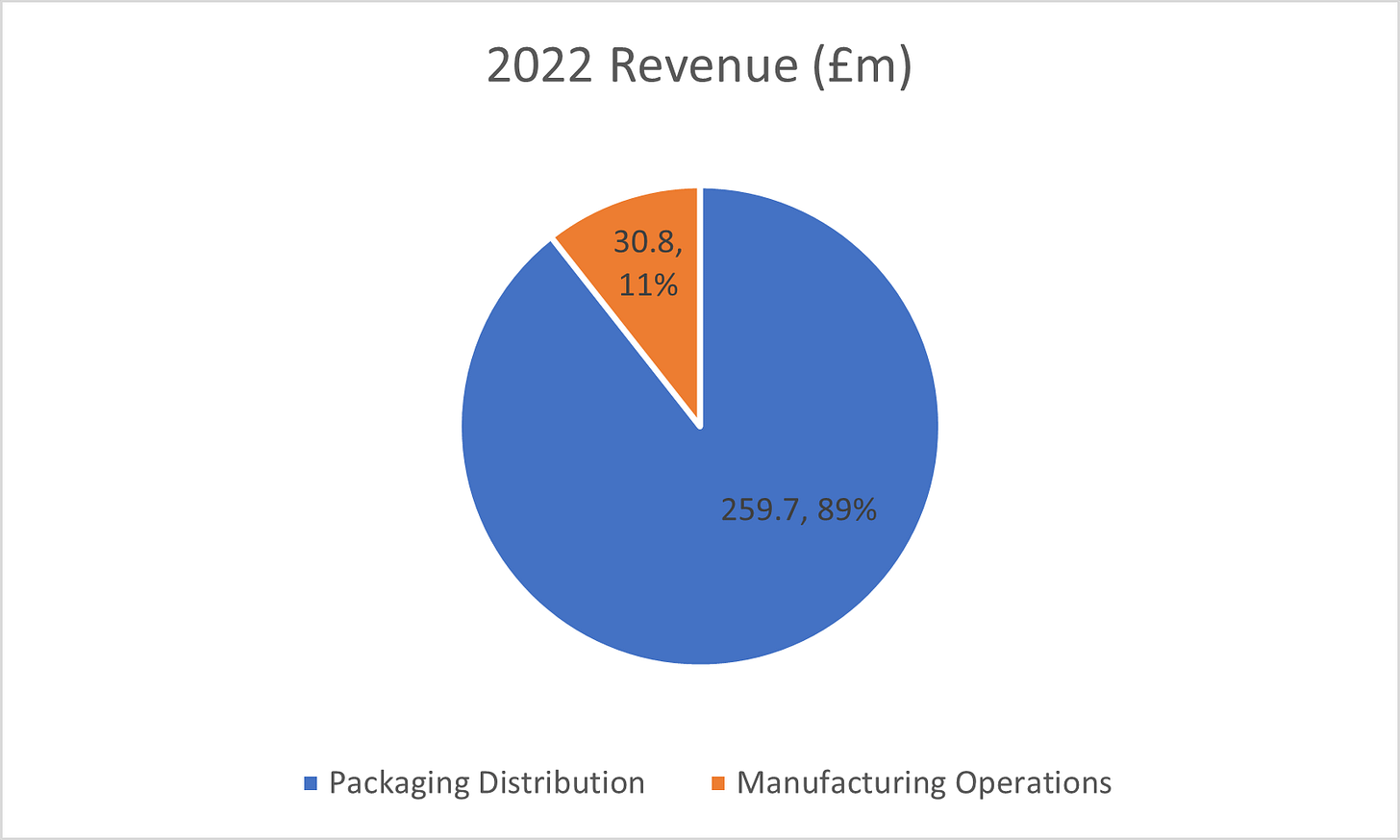

The Packaging segment distributes protective packaging materials and is the source of around 90% of total revenue, with an operating margin of 6.5% and sales growth of 8% in 2022. Distribution takes place from 31 centres across the UK and Europe and serves customers across a wide range of sectors including retail, medical, aerospace and hospitality. The segment targets growth from both organic and inorganic sources, with the 2022 acquisitions of Carters Packaging in Cornwall and PackMann in Germany providing £8.8m of sales growth.

Manufacturing Operations designs, manufactures and distributes bespoke packaging solutions for customers requiring protection of high-value products in transit. It uses corrugates, timber and foam as primary raw materials and operates from 4 sites in the UK. Competitive advantages are maintained through technical expertise, design capability and national coverage and the segment is a strong compliment to Packaging Distribution. Although only supplying 10% of total company revenue, sales growth for 2022 was 23% with an operating margin of 14.3%. Again, the segment relies on both organic and inorganic growth with sales growth of £4.4m from the 2021 acquisition of GWP.

A trading update given by the company in early May indicated Packaging sales had grown 4% in Q1 while Manufacturing sales grew 14%. The company has completed two acquisitions in the first 4 months. Suttons is a specialist in protective packaging based in Cambridgeshire and was acquired for a maximum consideration of £9m including a £2.5m earn-out if EBITDA targets are reached. The initial consideration was £6.5m, around 6x EBITDA, and is being financed through the existing £30m bank facility. Gottlieb, based in the North-West, supplies protective packaging through its team of 15 employees. The company is paying a maximum consideration of £3.55m which is 5x EBITDA and is financed again through the bank facility. Both acquisitions are immediately accretive to earnings.

Over the last 10 years, the share price has compounded at an impressive 13% CAGR (total 244% return) but has largely stagnated since 2018 with the company now valued at around £170m. Since 2013, revenue has grown at an 8% CAGR and net profit at an 18% CAGR. However, the share count has increased from 115m in 2013 to 160m in 2022 (3.3% CAGR) as the company has financed some of its acquisitions. Fortunately, management seem to have left this strategy behind in 2018 as share count hasn’t increased since then, and the business now consistently produces enough operating cashflow to fully finance any acquisitions. The dividend per share has also compounded at a respectable 8% per year and currently sits at a 3.2% yield.

Acquisition Strategy

Such a strategy is either hit or miss. Management must have exceptional capital allocation skills, carefully balancing inorganic growth with returning capital to shareholders. The below investor presentation slide shows the list of acquisitions since 2014.

Most acquisitions have been at an EBITDA multiple between 5 and 6. With the current EV/EBITDA multiple for Macfarlane sitting at 6, the acquired prices represent a commitment by management to avoid earnings multiple dilution, with some acquisitions benefitting from arbitrage. Since 2013, the company has spent £62.5m on acquisitions, a significant sum relative to their market cap.

Financial Overview

Aside from the impressive revenue growth, Macfarlane has worked well to achieve operational efficiencies, with both operating and net margins doubling over the last decade while maintaining returns on capital employed of 13-16%.

Free cashflow (FCF) is slightly more volatile. The traditional measure is determined through operating cashflow minus capex but with the business growth so heavily reliant on acquisitions, it is important to factor them in to the FCF calculation. This has meant that FCF was quite often negative prior to 2018, which potentially explains the frequent share dilution. Since 2018, FCF has always been positive, but with acquisition sizes varying from year-to-year, FCF margins have ranged from 9% to 2%, making prediction of future cashflows more difficult.

The balance sheet is healthy, total debt sits at £43m with £28m in long-term and £15m of short-term, of which £6m is lease liabilities. Cash position sits at £5m. Total debt has increased over the decade, but leverage ratios have been mostly unchanged, while interest coverage is consistently over 10.

Competitors

Robinson PLC – a tiny £15m market cap manufacturer and supplier of plastic and paperboard packaging in the UK, Poland and Denmark. They provide various HDPE and PET containers and paper packaging, commodity like items in my opinion. They have done well to double their revenue over the last decade, but earnings don’t seem to have followed, growing from £2m to £2.3m. The share price is also down 44% over the same time period.

DS Smith PLC – the giant of the industry at a £4bn market cap. DS Smith offers pretty much every type of packaging you could need, as well as waste management and recycling services and technical and supply chain services. Revenue has increased by just over double and like many UK businesses they pay a strong 5% dividend. EPS has doubled also and yet the stock is only up 26% in 10 years.

Valuation

Comparable Companies –

Discounted Cashflow Analysis –

The quantity of acquisitions Macfarlane makes and the different ways they finance them makes predicting future free cashflows difficult. I have opted to use the average FCF margin from the last 5 years where all years had positive post-acquisition FCF. This average is skewed slightly by the 8.6% margin in 2020 where the company paused aggressive acquisitions.

Revenue is expected to grow 10% in 2023 and I estimate 5% per year to 2027. FCF grows at the same rate and a 4.1% FCF margin is used. Historical margins, factoring in acquisitions are below;

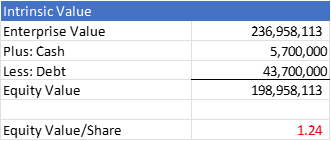

With a WACC of around 8% we get a target price of £1.24, and the current price sits at £1.09. I believe there is room to be more conservative on FCF estimates but as I said before it’s quite difficult to predict future cashflows.

PE Multiple –

Below are the historical multiples at year end;

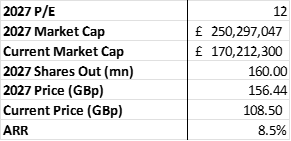

As you can see the business is currently valued near the lows of the decade. I feel the quality of the business and it’s strategy of acquiring its way into Europe will support mid-single digit earnings growth until at least 2027. With the business being somewhat cyclical through its reliance on customers ability to sell more products there is obviously concerns about a slow down in consumer spending. However, I believe with the huge range of customers they service, this cyclicality is limited. Management have seen a slowdown from e-commerce customers since the mad buying of lockdowns but still think long-term e-commerce is a growth runway.

I have assigned a 2027 multiple of 12 and earnings in 2027 are estimated at £20.9m (30% growth across 5 years).

Conclusion

Macfarlane is a high-quality business with an impressive track record of making small, earnings-accretive acquisitions. By continuing to acquire local and regional competitors the business can enforce pricing power and a successful inorganic expansion into Europe would greatly increase TAM. Management may want to look at funding more acquisitions using cashflow over debt, as interest rates continue to rise (average interest rate on their debt for 2022 was 4.5% compared to 2.7% in 2021). The current price seems reasonable but reflects some uncertainty from investors regarding the cyclicality of the business and increasing interest payments. I am considering building a position in the company.

They actually have been increasing margins, operating margin has grown from 4.1% in 2013 to 7.4% in 2022 while net margin has grown from 2.4% to 5.4%

Is there any prospect of them improving profit margins?